Stay up to date on the latest SwitchPitch developments

Innovations of the Past and the Imperative of Innovation Moving Forward: Innovation used to be Read more

Venture capital has been the backbone of innovation for quite some time, providing support to Read more

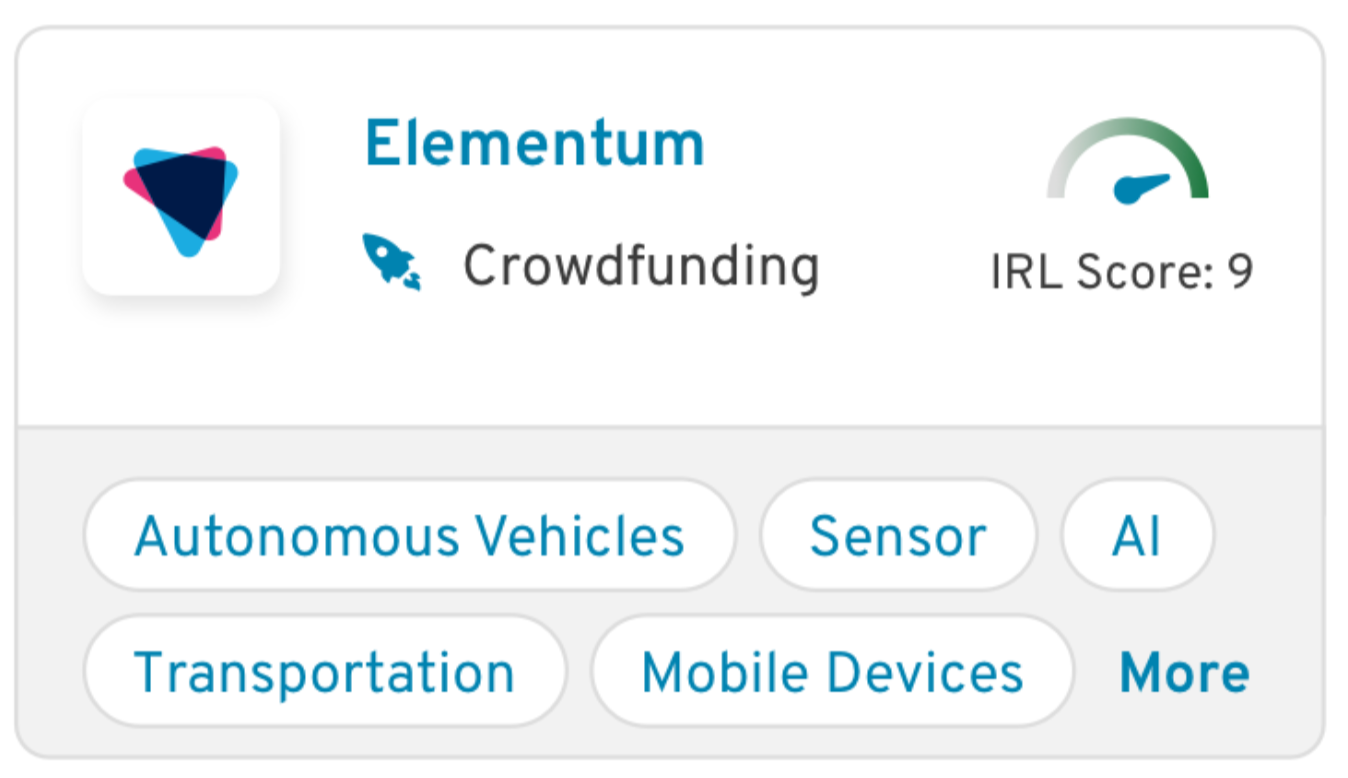

SwitchPitch is excited to announce our new Innovation Readiness Level score to uniformly capture how Read more

We are thrilled to announce the launch of SwitchPitch’s brand-new monthly newsletter. As a trusted Read more